Paycheck percentage calculator

Ad Create professional looking paystubs. It can also be used to help fill steps 3.

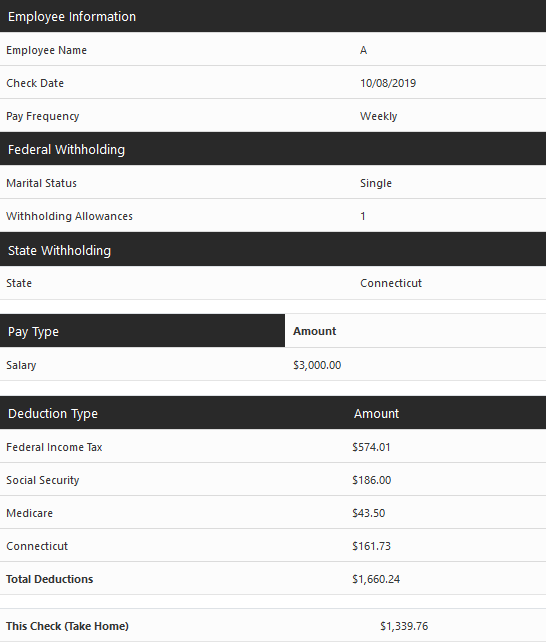

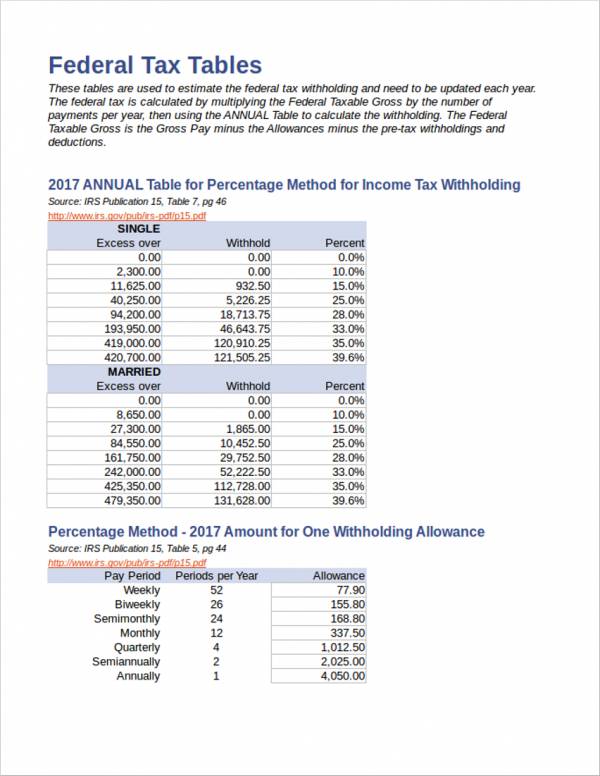

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

1 day agoThe rates have gone up over time though the rate has been largely unchanged since 1992.

. In a few easy steps you can create your own paystubs and have them sent to your email. Subtract any deductions and. California Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state.

You can enter your current payroll. Use the calculator below to determine how much you have left to put toward your savings goals per paycheck after bills and expenses. Ad Get the Paycheck Tools your competitors are already using - Start Now.

Payroll Deductions Calculator Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Ad Calculate Your Payroll With ADP Payroll. Ad Create professional looking paystubs. View Gross-Up Payroll Calculator Calculate.

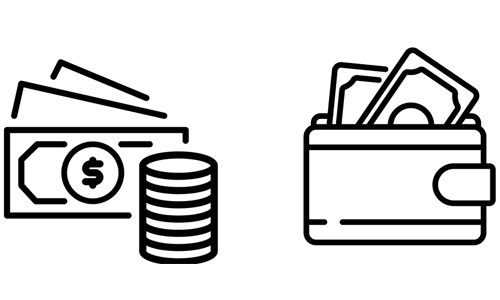

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Work out your adjusted gross income. The Best Online Payroll Tool.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Once youve calculated how much you have to allocate. Ad Get the Paycheck Tools your competitors are already using - Start Now.

Ad Calculate Your Payroll With ADP Payroll. Approve Hours Run Payroll in App. We use the most recent and accurate information.

Federal payroll tax rates for 2022 are. Get Started With ADP Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Figure out your filing status. The Best Online Payroll Tool. If you are enrolled in an employer-provided health insurance plan any premiums you pay will come from your salary.

Payroll Done For You. ACA Pay or Play Calculator. This number is the gross pay per pay period.

Approve Hours Run Payroll in App. Process Payroll Faster Easier With ADP Payroll. 401 k Planning Calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. FICA Tip Credit Calculator.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty. Process Payroll Faster Easier With ADP Payroll. Similarly if you choose to invest in a 401k or 403b retirement plan.

Ad Run Easy Effortless Payroll in Minutes. We use the most recent and accurate information. Total annual income Tax liability All deductions Withholdings Your annual paycheck Thats the five steps to go through to work your paycheck.

62 for the employee. Social Security tax rate. You need to do these.

Payroll Done For You. Heres a step-by-step guide to walk you through. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Get 3 Months Free Payroll. Choose Your Paycheck Tools from the Premier Resource for Businesses. Follow the simple steps below and then click the Calculate button to see the results.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Get 3 Months Free Payroll. Hourly Paycheck Calculator Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees.

Enter your current pay rate and select the pay period Next enter the hours worked per week and select the. In a few easy steps you can create your own paystubs and have them sent to your email. Ad Run Easy Effortless Payroll in Minutes.

Next divide this number from the annual salary. Get Started With ADP Payroll.

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator And Salary Calculator Employment Laws Com

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Salary Calculator Net Income My Pay Mypercentcalculator

How To Calculate Federal Withholding Tax Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Gross Pay And Net Pay What S The Difference Paycheckcity

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Us Apps On Google Play

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator